What does Alimony "cost"?

I am in the middle of negotiating the resolution of a high net worth divorce. My client (Husband/Dad) is in finance and earns about 35k per month. Wife earns about 5k per month. Over their 28 years they have acquired about 5 million in cash, retirement and hard assets and no debt.

My client has a periodic alimony obligation of some amount. Opposing counsel wants over 10k per month. In working up a response, I need to know how much my client must earn in order to pay a sum of alimony to Wife.

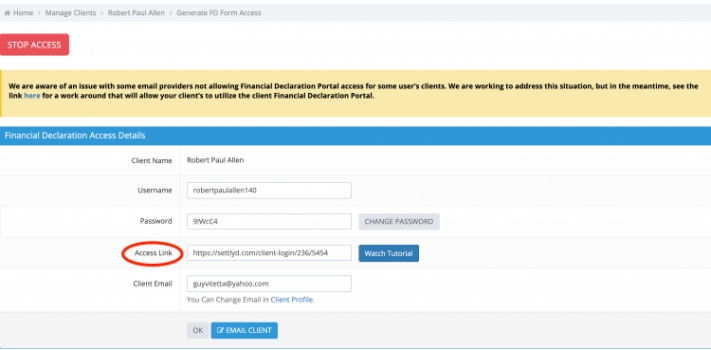

Settlyd's Alternativer Tax Calculator (ATC), found on the sdiebar just above the link to the Guidelines, can help figure this out.

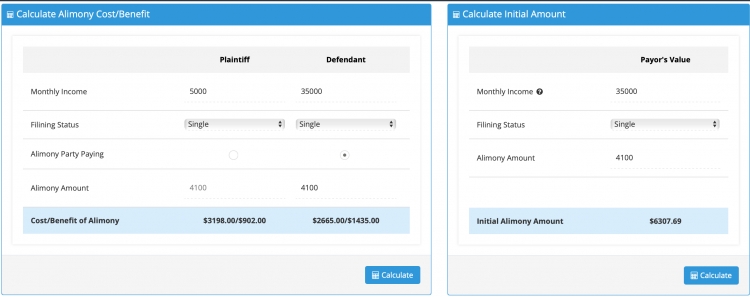

For me, the most important number I need is "Calculate Initial Amount". As is shown above, in order to pay $4,100 per month, my client must earn $6,307.

Next, the Calculate Alimony Cost/Benefit tool tells me the cost/benefit under the old law. Why is this important? Because it shows that Wife's receipt of a non taxable $4,100 is the same as her receiving an extra $902.

So, under the new IRS rules regarding alimony, while there is no reportable income or deduction from income, there is still a cost to the payor and a benefit to the Payee. When we use the ATC we are using a reasoned approach based upon objective facts. This helps keep the emotions at bay and can lead to a more peaceful resolution.

Be well and stay safe,

Guy and Sean