Understanding Alimony Buyouts in Divorce

When couples divorce, ongoing alimony payments can create financial uncertainty for both parties. One alternative that’s gaining popularity is the alimony buyout — a lump-sum payment that replaces future spousal support obligations.

What Is an Alimony Buyout?

An alimony buyout allows the paying spouse to make a single, upfront payment instead of monthly support over time. This amount represents the present value of expected future payments.

Benefits of a Buyout

- Clean Break: Both parties can move on without ongoing financial ties.

- Predictability: The receiving spouse gets guaranteed funds immediately, avoiding the risk of missed payments or future income changes.

- Simplicity: Eliminates the need for future modifications or enforcement actions.

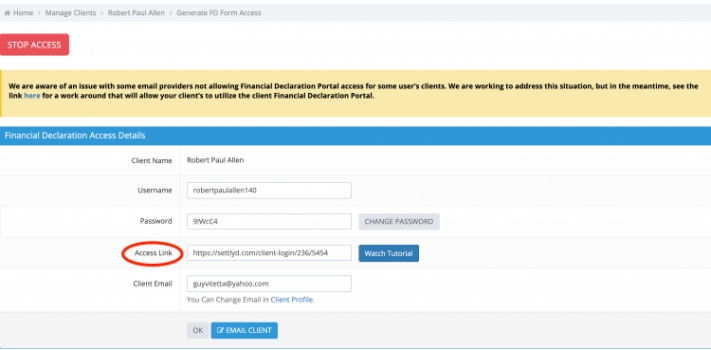

How Settlyd can help

Buyouts aren’t right for everyone. The lump sum must be carefully calculated to ensure fairness, and both parties should consult financial and legal professionals to assess tax consequences and long-term needs. Once finalized, buyouts are typically non-modifiable, so there’s no revisiting the amount later. Given this, we suggest using Settlyd's Asset Division worksheet and the Net Income worksheet to analyze the appropriateness of this kind of award. Once you look it over on the worksheets, it may be a safer bet to to with simple periodic payments.

Final Thoughts

An alimony buyout can provide clarity and closure — but it requires thoughtful analysis and sound advice. When structured properly, it’s a powerful tool for simplifying post-divorce finances and securing stability for both spouses.