Pensions and Divorce.

A pension is a retirement plan sponsored by an employer. Today, almost all pensions are provided by the government and unions. Pensions pay a monthly annuity to the employee upon retirement.

An employee who is eligible for a pension benefit is called the Participant; they are the "participant" in the pension plan. The spouse who has a claim to a portion of the pension is called the Alternate Payee. Dividing pensions in divorce can be a tricky matter. It must be done with full knowledge of your options and the potential pitfalls to avoid.

Is A Pension Divided Equally?

Only the marital portion of the pension is subject to division when dividing pensions in divorce. For example, if Sally had been contributing to her Federal Civil Service Retirement Service (CSRS) pension plan for 20 years, and had been married to her husband for 15 of those years, then only 3/4 of Sally's pension would be considered marital and subject to division.

It does not matter if the participant is still working or is retired and collecting their benefits. If the Participant acquired any portion of the pension benefit during the marriage, that portion, no matter how small or large, will be subject to division.

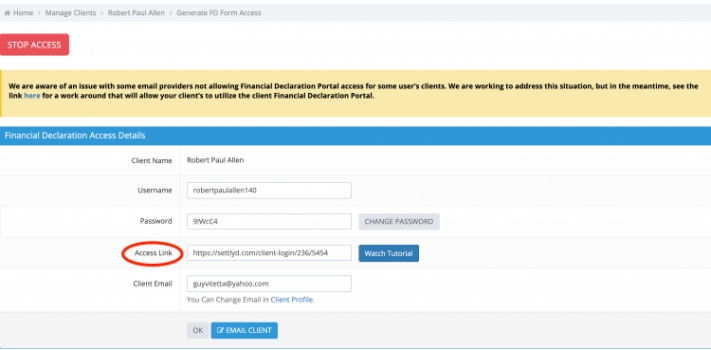

Settlyd's Coverture Calculator is a quick and accurate way to find the marital portion of a pension benefit.

How Is A Pension Divided?

A pension benefit must be divided by Court Order. These Orders are called by various names, such as Qualified Domestic Relations Order, or QDRO, Court Order Acceptable for Processing (CSRS), a Military Qualified Court Order (Armed Forces).

A properly drafted Court Order has many benefits and protections for the Alternate Payee, such as:

- Ensuring Cost of Living (COLA) increases

- Ensuring that the Alternate Payee will receive the benefit should the Participant die before the benefits are scheduled to begin

- Ensuring that the benefit will continue to be paid to the alternate payee should the Participant die the after the benefits begin to be paid.

How Is The Pension Benefit Paid Once It Has Been Divided?

The most common way is to simply prepare a Qualified Domestic Relations Order (QDRO) to divided the pension benefit once it is in pay status. In other words, once the pension begins to be paid to the Participant, the Alternate Payee will get a separate monthly payment from that Plan reflecting his or her share.

A less common way of dividing pensions in divorce is to calculate the Lump Sum Net Present Value of the benefit to the Alternate Payee and then pay this out of other marital assets. The amount is determined by multiplying the expected monthly annuity by life expectancy. This sum is then "discounted" to determine the value of this sum in today's dollars.

Net present value can be problematic as it relies on certain guesstimates such as a life expectancy and the discount rate.

Given the choice, courts will almost always (I have never seen otherwise) chose to divide a pension via QDRO rather than a net present value calculation.

Guy Vitetta

Charleston