How To Account For Special Equity In Divorce Litigation

Settlyd member Steve Futeral defines Special Equity on his outstanding website as follows: "A special equity interest is created when one spouse’s direct or indirect contributions increased the value of the other spouse’s non-marital property." The most common example is when one spouse makes an improvement to another spouses separate property (such as a home) which then, as a direct result, increases its value.

This increase in value of non marital property, or Special Equity, is itself separate property. It is only fair that, should the marriage come to an end, a person who has significantly improved the property of another be permitted to re-coup his or her contribution.

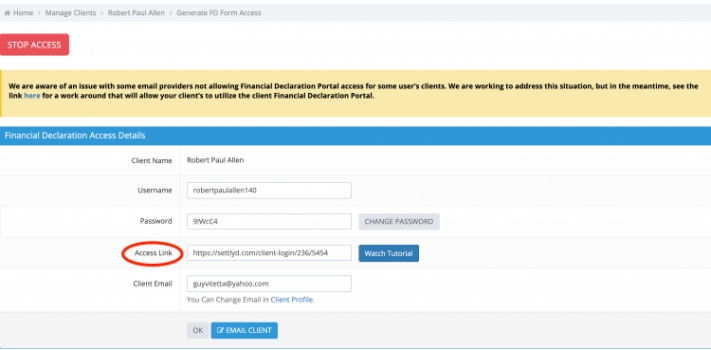

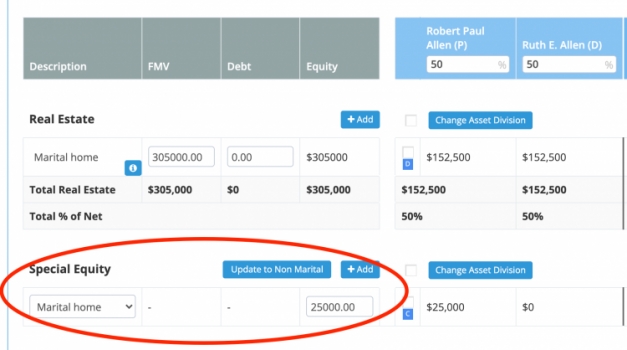

Settlyd has created a dedicated line item for Special Equity to account for these situations. The Special Equity line item is found on the Asset Division Worksheet just below Real Estate.

The Settlyd Asset Division worksheet will treat special equity as non marital property. The Asset Division worksheet will calculate special equity as a credit to the receiving party but not a corresponding debit in Total Net Distribution as it is not part of the marital estate.