How is Child Support In South Carolina Determined?

When parents of children no longer live together, South Carolina law mandates that both parents shall be financially responsible for raising their children. The amount of each parents financial responsibility is determined by the South Carolina Child Support Guidelines.

The South Carolina Child Support Guidelines determine the percentage of each parent's income that would have normally be devoted to caring for the children had the parents remained living together. In other words, the support obligation is pro-rated between the parents depending on their share of the total income. For example, if a child’s custodial parent makes $2,000 a month and the noncustodial parent brings in $3,000, the noncustodial parent assumes 60% of the support obligation. South Carolina law requires that the South Carolina Department of Social Services establish the Guidelines. The statute specifically mandates that

The department shall promulgate regulations which establish guidelines for minimum contributions which must be applied by the courts in determining the amount that an absent parent is expected to pay toward the support of a dependent child. Copies of the guidelines must be made available to courts, district attorneys, and to the public.

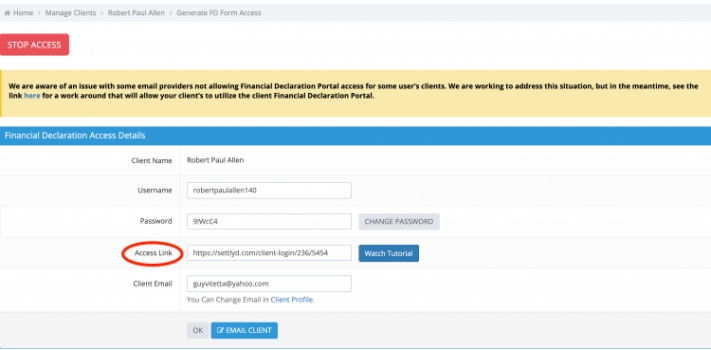

In addition, our Court of Appeals has ruled that “in determining the amount of child support, the family court is generally required to follow the child support guidelines; although the family court may deviate from the guidelines, any deviation must be justified and should be the exception rather than the rule.” LaFrance v LaFrance. It is important to note that section 63-17-470 of the South Carolina Code creates a rebuttable presumption that the Guidelines are correct! Traditionally child support was calculated by hand in South Carolina by filling out the paper worksheets. As technology has developed the Guidelines have been automated with software such as Settlyd. However, Attorneys sometimes wonder why the handwritten worksheets, the online DSS calculator and other calculators all differ slightly when using the same numbers. The simple answer is that the Guidelines are a written set of algebraic instructions that leave the actual calculations up to the user. Decimal place and rounding decisions will often cause the end result to vary slightly, yet all will be in a accord with South Carolina law ( See § 63-17-470; Sherman v. Sherman).