How Can A Family Law Attorney Resolve Unique Child Support Issues.

Often, calculating a South Carolina Child Support award is straightforward math. But when parenting arrangements do not fall squarely within the South Carolina Child Support Guidelines, a stronger tool is needed by a Family Law Attorney. Guidelines, by definition, don't provide definitive answers to all questions about child support.

Under South Carolina Law, children should receive the same proportion of parental income that they would have received had the parents lived together. The formulas in the Child Support Guidelines address amounts of child support in 3 situations: when all the children live primarily with one parent, when children in a family don't all live with one parent, and when the children spend about the same amount of time with each parent.

But sometimes a grandparent or other third party is raising the children. The Guidelines don’t provide any formula for a Family Law Attorney to determine a fair amount of support to this third party. Because each third party custodial arrangement is unique, Family Law Attorneys need tools that are flexible enough to consider many variables and analysis that provides clear options.

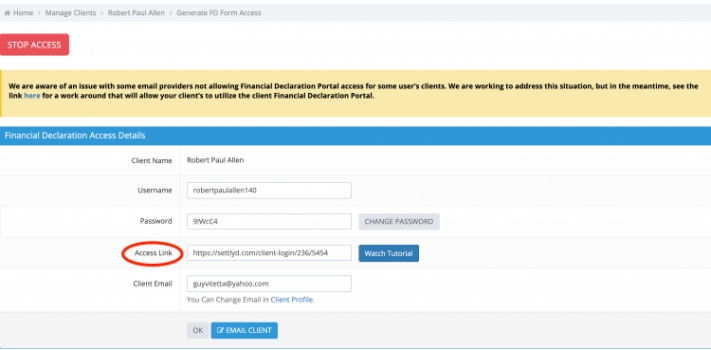

New software, available to South Carolina Family Law Attorneys and financial professionals, provides fair, uniform calculations that can reasonably be relied upon in circumstances not contemplated by the Guidelines. The Third Party Child Support Calculator in Settlyd.com establishes reasonable support amounts when a third party is parenting children of separated or divorced parents. Settlyd calculates the amount of support using the existing guidelines, and considering the varied approaches to tax credits available in third party custodial arrangements.

Using the Settlyd.com Child Support Calculator, the parties and their Divorce and Family Law Attorneys organize data, discuss and revise options according to the family's needs. Ultimately, the Settlyd tool allows the parties to take a clear set of options to the Court, which has the final authority for approving or determining child support arrangements.

Another Child Support issue that is not addressed by the South Carolina Guidelines is when parties have combined incomes that exceed the guideline tables. South Carolina Child Support Guidelines do not address families whose monthly income is above $30,000. Some Family Law Attorneys “extrapolate” figures from the schedule, if they are good at math, but often they don't have the skills to accurately determine the amount of support and spend thousands of dollars on CPA's to do this math.

Since these cases are to be determined case-by-case, there is no mandated formula. The Settlyd Excess Guidelines calculator provides two different calculations, both based on extrapolations from the existing South Carolina Child Support Guidelines. It provides attorneys with the mathematics and analysis for cases in which the parties' income exceeds the range addressed by the Guidelines.

Settlyd.com is a tool for organizing the financial data and providing clear options for discussion and resolution of unusual child support issues in unique family circumstances. Settlyd.com makes the data clear and manageable which reduces the uncertainty and anxiety endemic in Family Law litigation. Settlyd.com helps attorneys and financial professionals provide clear options for families seeking to resolve family conflict and move beyond it.